Date of Withdrawal: 01-Jan-2014

Plan No. 149

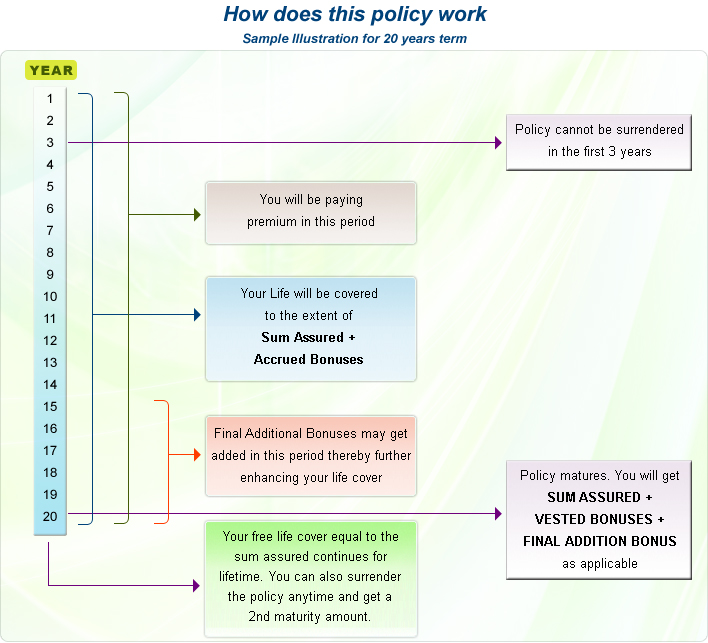

- A combination of Endowment and Whole Life Plan. Provides for a maturity amount after a pre-decided term and a whole life cover thereafter too

- Premiums are payable for a pre-decided term only.

- LIFE COVER: Sum Assured + Bonus + Final Addition Bonus (as applicable) during the predecided term. After that life cover is equal to the sum assured for the rest of life

- MATURITY: Sum Assured + Bonus + Final Addition Bonus (as applicable) will be paid at the end of predecided term.

- WIDE CHOICE OF TERM - can be easily aligned with your family objectives

- LIQUIDITY: You have an option to surrender the policy & receive the cash value after payment of premiums for 3 years. Loan is also available on this policy when it acquires surrender value. Policy can also be surrendered for a cash value after the maturity benefits have been paid. Thus in a way, it provides an option for 2nd maturity value.

- FREE built-in Accident Benefit rider upto Rs. 5 Lacs

- Premiums paid are TAX EXEMPTED u/s 80 C

- Maturity amount is TAX FREE u/s 10 (10) (D)

- Optional Add-on Riders:

- Critical Illness Rider – Pays the sum assured under this rider on occurrence of any critical illness. Wide list of illnesses are covered.

| Eligibility Criteria |

|

Min. |

Max. |

| Age |

18 |

65 |

| Term |

5 |

57 |

| Sum |

1,00,000 |

No limit |

| Premium Modes |

Yly,Hly,Qly,Mly,SSS |

| Yearly Premium for 10,00,000 Sum Assured |

| Age |

15 Years |

20 Years |

25 Years |

| 25 |

74158 |

52577 |

39751 |

| 30 |

76292 |

54274 |

41206 |

| 35 |

78959 |

56408 |

43097 |

| 40 |

82209 |

59124 |

45474 |